Penalty for Non-Payment of Road Taxes in Kolkata There is a grace period of 15 days during which a person should clear his dues. 100 of the tax payable.

Transport Dept To Waive 100 Road Tax Penalty The Statesman

Transport Dept To Waive 100 Road Tax Penalty The Statesman

Date by which to appear.

Road tax penalty in west bengal. 25 of the tax payable. Same is the case in West Bengal. Penalty for Late Payment of Road Tax in West Bengal Those who do not pay road tax within the grace period in West Bengal have to pay an additional tax amount as a penalty for late payment.

For the delay from 16th to 45th day after the expiry. Name and address of offender. General details of offences committed.

West Bengal that still a large number of. For example if you are paying the tax from 16 to 45 days from the expiry date you will have to 25 of the tax payable. In this article we look at the various aspects of West Bengal Road Tax in detail.

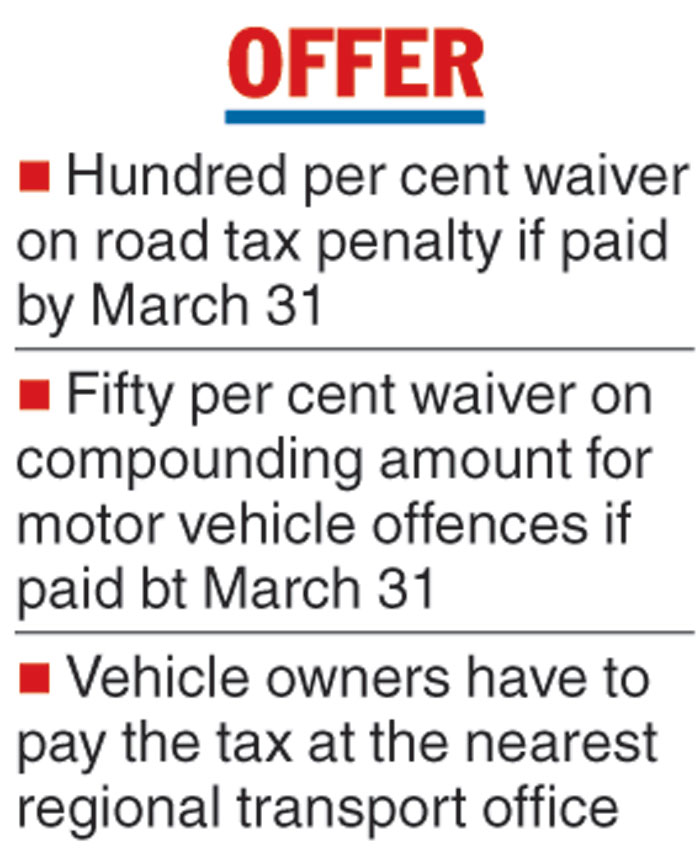

Bengal Motor Vehicles Tax Act 1979 and Section 23A West Bengal Additional Tax and Motor. The State Government Of West Bengal had offered a 100 waiver on any penalties for taxes due of any kind and accrued by any vehicle as long as the taxes were paid within a. A notification had been issued by the transport department on 24 July and this had said that no penalty would be levied on road tax on.

What is the penalty charged to a road tax defaulter in West Bengal. Road tax will be 55 of original Invoice value or rs 35000 which ever is higher - in case of One time tax payment Tax renewal option for Old cars with ageing of 5 years has One Time valid for 5 year or Life Time valid for 10 year. West Bengal Vehicle Tax Act1979.

These taxes are a key source of revenue for meeting state expenditure. Owing to fewer vehicles on road. The following table illustrates the road tax rates as per the duration of delay.

There are several rates of penalties payable for a defaulter. What happens when a case is lodged against your vehicle. For the delay for more than 75 days after the expiry.

Seizure list will be issued to you containing the following details. Road tax has to be paid by the vehicle owners at the time of registering their vehicle with the Regional Transport Office. For the delay from 46th to 75th day after the expiry.

For 5 Year Road Tax - it would be Rs 25000 For LTT 10 Year Road Tax - it would be Rs 41000 In terms of Penalty fine clause - there is provision of 100 fine which is applicable in case of delayed registration renewal Best to contact RTO Officer on fine amount calculation Hope should help. Representational image Kolkata. Under Section 39 of the Motor Vehicle Act 1988 all motor vehicles in the state of West Bengal are subjected to on-road taxes mentioned by the state and central government registration charges and cost of vehicle insurance.

West Bengal waives tax penalty for all except private buses. Road Tax Receipt. West Bengal road tax primarily depends on several factors such as vehicle type two-wheelers four-wheelers usage purpose personal commercial model engine capacity seating capacity etc.

The Bengal transport department has now extended the time to pay road taxes till September 30th and this is without penalty on commercial vehicles. Failure to do so may lead to the following penalties - A delay from 16th to 45th day25 of tax amount. 50 of the tax payable.

The authority before which you are required to appear. If the owner fails to pay the road tax within 45 days from the stipulated grace period he would have to pay 25 per cent of the tax amount as penalty. No penalty is imposed if the vehicle owner pays the tax after the due date but within the grace period.

As per the provisions under the West Bengal Vehicle Tax Act 1979 the transport department is liable for. Transport dept to waive 100 road tax penalty. Name and signature of the seizing officer.

The vehicle owners can refer to the below-mentioned list to know about the applicable road tax in detail. The Bengal government said on Friday that road tax on all passenger transport vehicles will be waived from January 31 2021 to June 30 2021 for two qua. Home Bengal Transport dept to waive 100 road tax penalty.

The West Bengal transport department has offered a 100 per cent waiver of penalty on tax default for all types of registered vehicles in the state an official.

Motor Vehicle Offence West Bengal Offers Penalty Waiver On Tax Default For Vehicles Auto News Et Auto

Motor Vehicle Offence West Bengal Offers Penalty Waiver On Tax Default For Vehicles Auto News Et Auto

Fine Breather For Road Tax Dues In Bengal Telegraph India

Fine Breather For Road Tax Dues In Bengal Telegraph India

Fine Breather For Road Tax Dues In Bengal Telegraph India

Fine Breather For Road Tax Dues In Bengal Telegraph India

Coronavirus Pandemic Road Tax Relief By Bengal Transport Department Till September 30 Telegraph India

Coronavirus Pandemic Road Tax Relief By Bengal Transport Department Till September 30 Telegraph India

Transport Department West Bengal 100 Waiver On Road Tax Penalty On Motor Vehicles Ad Advert Gallery

Transport Department West Bengal 100 Waiver On Road Tax Penalty On Motor Vehicles Ad Advert Gallery

West Bengal Road Tax Applicability Road Tax Rates Fincash

West Bengal Road Tax Applicability Road Tax Rates Fincash

Coronavirus Lockdown Hill Taxi Owners Stare At Road Tax Penalty Telegraph India

Coronavirus Lockdown Hill Taxi Owners Stare At Road Tax Penalty Telegraph India

All You Need To Know About Lto Penalties For Expired Car Registration Rates Schedules And Faqs

All You Need To Know About Lto Penalties For Expired Car Registration Rates Schedules And Faqs

West Bengal Road Tax Calculate Penalty Charges Pay Road Tax Featuredsource

West Bengal Road Tax Calculate Penalty Charges Pay Road Tax Featuredsource

West Bengal Waives Off Penalty On Taxes For Transport And Commercial Vehicles Drivespark News

West Bengal Waives Off Penalty On Taxes For Transport And Commercial Vehicles Drivespark News

Pin By Chandrashekhar On Master Tax Return Times Of India Carry On

Pin By Chandrashekhar On Master Tax Return Times Of India Carry On

Rbi Imposes Monetary Penalty On Bajaj Finance Limited In 2021 Finance Code Of Conduct Management

Rbi Imposes Monetary Penalty On Bajaj Finance Limited In 2021 Finance Code Of Conduct Management

No Penalty For Driving With Expired Licences Other Documents Until Sept 30 Latest News India Hindustan Times

No Penalty For Driving With Expired Licences Other Documents Until Sept 30 Latest News India Hindustan Times

Validity Of Vehicle Documents Extended Till July 31 No Penalties For Delays The New Indian Express

Validity Of Vehicle Documents Extended Till July 31 No Penalties For Delays The New Indian Express

Rera Blogs Blog Highway Signs Need To Know

Rera Blogs Blog Highway Signs Need To Know

What Can Be Done When The City Police Tow The Vehicle In A Non Parking Zone Law Times Journal

Registering Your Vehicle After 15 Years Set To Get Costlier Govt Proposes Increase In Fee

Registering Your Vehicle After 15 Years Set To Get Costlier Govt Proposes Increase In Fee

You May Have To Pay 1 000 As Fine For Parking Violation The Hindu

0 Response to "Road Tax Penalty In West Bengal"

Posting Komentar